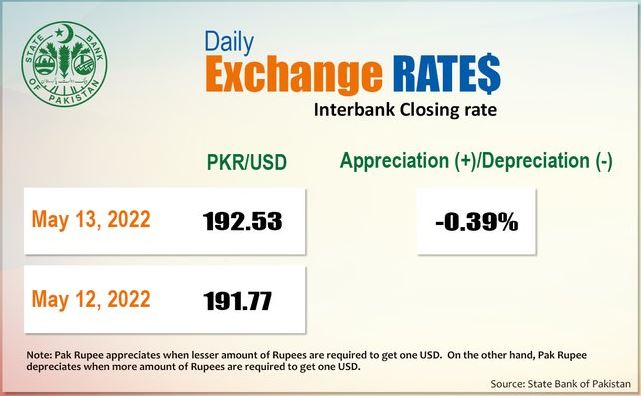

Dollar reaches an all-time high and pushes past Rs194.

On Monday, the dollar climbed above Rs194 versus the rupee in the interbank market, as analysts expressed concern about the country’s mounting import bill.

The greenback gained Rs1.30 from Friday’s close in interbank trade to reach Rs194.30 about 11:30 a.m., according to the Forex Association of Pakistan (FAP).

This comes after the rupee fell to fresh lows last week, owing to the country’s mounting import bill.

The dollar was worth Rs182.3 when the PML-N-led coalition government gained power on April 11. The rupee has lost Rs11.4 or 6.2 percent of its value since then.

The greenback had closed at Rs193 according to FAP estimates. The rupee’s depreciation is primarily due to an uncontrolled increase in imports combined with a slower rate of growth in exports. The trade deficit, which reached $39 billion in July-April, reflects this.

Meanwhile, the central bank’s foreign exchange holdings have fallen to $10.3 billion, the lowest level since June 2020. The import cover, which indicates a country’s ability to pay for foreign purchases in international currency, has dropped to a pitiful 1.54 months.

The main reason for the currency market’s optimistic trend, according to currency dealers, is increasing demand for dollars. The current government’s political inaction on the reversal of fuel and energy subsidies, which is required for the loan programme to resume.