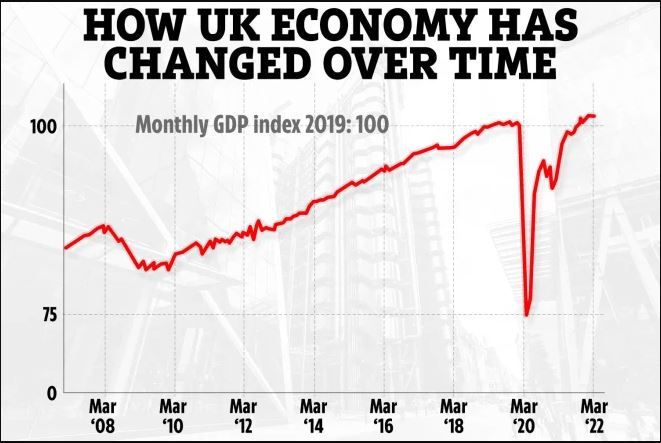

The UK GDP has shrunk by 0.1 percent as fears of recession.

Official numbers released today show that the Gross Domestic Product (GDP) has plunged into negative territory, following a month of 0% growth.

The latest data has fueled fears that the United Kingdom may enter recession.

Boris Johnson declared yesterday that he intends to cut through Brussels red tape in order to boost Britain’s weak economy.

As millions of people struggle with rising bills, Chancellor Rishi Sunak is said to be on the verge of punishing energy companies with a windfall tax.

Overall GDP, however, is presently 0.7 percent greater than it was when Covid struck in February 2020.

The UK economy grew by 0.8 percent in the first quarter of this year (January to March).

However, this is still less than the 1 percent rise expected by economists.

The Office for National Statistics (ONS) calculates GDP on a monthly basis and uses it to determine whether or not the economy is increasing.

It’s significant because faster growth indicates a higher standard of living, which could lead to more jobs, raises in salary, and money to invest in keeping the country operating.

According to the source, the main reason for the contraction in March was a drop in the services sector.

As people are compelled to cut back on spending, the wholesale sector (which includes enterprises that sell big quantities of items to retailers at affordable costs) and retail sector both decreased by 15.1 percent.

“The UK economy rebounded rapidly from the worst of the pandemic, and our growth in the first few months of this year was strong – faster than the United States, Germany, and Italy – but I understand these are still worrying times,” Rishi added.

He blamed the UK economy’s disruption on the current Russia/Ukraine issue.

“Growth is the best way to support families in the long run,” he added. “So, in addition to relieving immediate burdens on households and companies, we’re investing in capital, people, and ideas to enhance living standards in the long run.”

He went on to say that the UK economy’s modest growth was “the slowest in a year.”

It comes as concerns about a future recession intensify.

Is a recession on the way?

A country’s economy is not technically in recession until it has fallen for two consecutive quarters (six months).

A recession is undesirable because it frequently results in job losses and salary stagnation.

As a result, the government will get less tax revenue, perhaps reducing services and benefits.

Recessions can be triggered by a variety of factors, including war, crop failures, and the Covid epidemic.

The UK is still a long way from being in recession, as this is the first month that GDP has fallen. Unemployment is also still quite low, having dropped to 3.9 percent in March.

However, economists believe that economic development will stall this year as inflation soars and energy, fuel, food, and transportation costs rise.

The government’s Office for Budget Responsibility lowered its growth forecast for 2022 to 3.8 percent, from a previous estimate of 6% in October.

What else is going on?

Meanwhile, the Bank of England has warned that inflation could reach 10% in the coming months.

In an additional blow to home finances, interest rates were raised to 1%, increasing mortgage payments by £612 per year.

The cost of living crisis, according to Quilter Investors portfolio manager Hinesh Patel, “is only going to grow worse for consumers.”