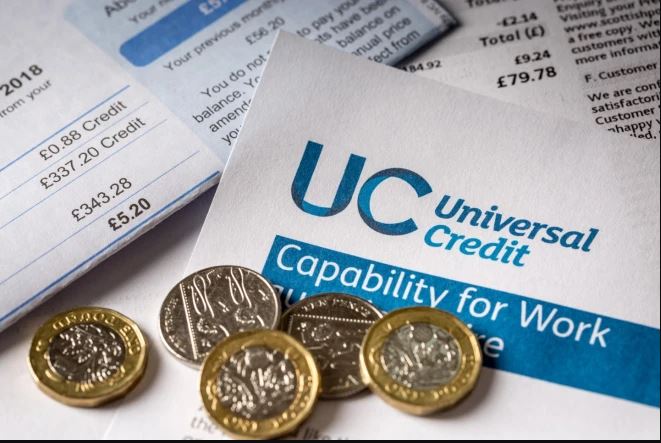

People on Universal Credit can get a £1,200 extra.

Household who apply for Universal Credit may be eligible for a £1,200 bonus to help them save.

Millions of individuals on benefits are eligible for a cash boost to help them save.

The Help to Save scheme is a savings account for those on Universal Credit or Working Tax Credit.

On top of the money saved in the account, savers will receive a bonus.

A bonus of £1,200 is the highest amount that can be given.

We go over how the Help to Save programme works, who qualifies, and how to apply.

How does the Help to Save programme operate?

Every 50p saved will be rewarded with a 50p bonus.

You can save between £1 and £50 each month, so if you paid in the maximum amount each time, you’d get a £25 monthly bonus.

Over the course of a year, this adds up to £300, and over the course of four years, it adds up to £1,200.

Your bonuses will be credited to your account at the end of the second and fourth years.

If you don’t want to or can’t afford to, you don’t have to pay in every month.

Account holders can withdraw money at any time, but this will reduce the amount of bonus money they earn.

You can save money with a debit card, a standing order, or a bank transfer if you open a savings accounts.

After four years, the account will close and you will not be able to apply for another.

You will miss your next bonus if you close your account before the four years are over, and you will not be allowed to restart it.

What types of people are eligible for a Help to Save account?

If you meet any of the following criteria, you can open a Help to Save account:

Working Tax Credit is being paid to you.

You are claiming Universal Credit and are entitled to Working Tax Credit and Child Tax Credit, and you earned £658.64 or more from paid work in your latest monthly assessment period (with your partner if it’s a joint claim).

If you and your partner receive payments as a couple, you and your partner can each apply for your own Help to Save account.

With two exceptions, most applicants must reside in the United Kingdom:

member of the British armed forces or their spouse or civil partner member of the British armed forces or their spouse or civil partner

Even if you stop claiming benefits during the four years while your Help to Save account is active, you can keep it.

If you or your partner have £6,000 or less in personal savings, including your Help to Save account, your Universal Credit payment will not be affected.

How can I get an account with Help to Save?

You can apply for an account online through the government website if you are eligible.

To open an account, you’ll need a Government Gateway user ID and password, which you can generate as part of your application.

When you apply, you’ll be asked for your UK bank details, so make sure you have them handy.

Universal Credit applicants have been told that if they miss a key date, their payments may be terminated.